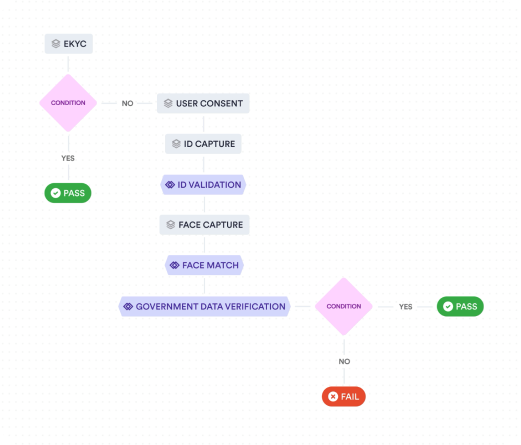

Know your customer (eKYC)

Know your customer (eKYC)

Offer end users an easy sign-up and non-document verification that’s compliant with global KYC/AML regulation, and optimized for conversions

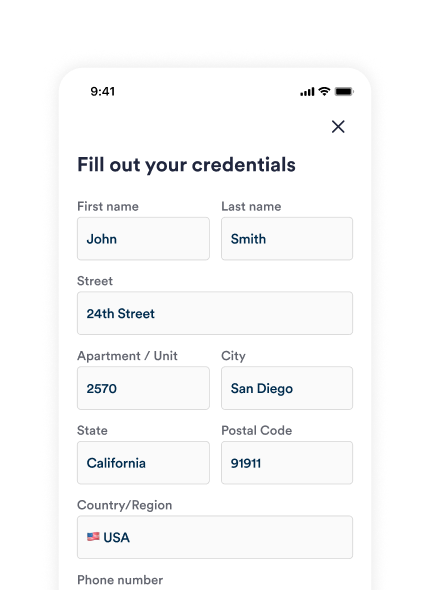

Optimize business compliance and security by requesting only essential user information.

- Compliance: Ensure day-one compliance with KYC and AML across all global markets. Our commitment is to keep your solution compliant with every regulatory change

- Coverage: Unlock superior match rates across 200+ countries through our extensive integration with diverse public and private data sources

- Pre-filled fields: save your users time with pre-populated fields

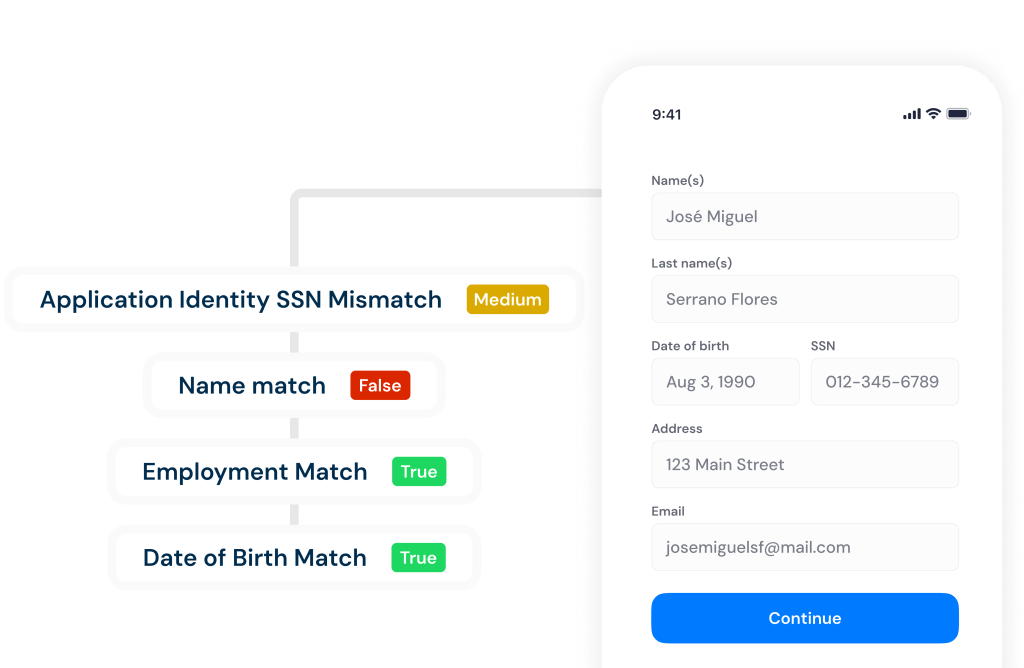

Tailored onboarding solutions based on your requirements and users’ risk profile

- Adaptive user paths: Effortless verifications with a 99% success rate achieved within seconds on the initial attempt

- IDV step-up: Conditional logic and other signals automatically step-up users to IDV (doc scan + selfie) when needed

- Pre-built templates: Choose from a diverse range of pre-made modules for KYC, Kantara Compliance, Age Verification, AML, and additional features

- eKYB: Seamlessly integrate with eKYB for comprehensive business and individual verifications using just one implementation

Our verifications are enhanced with additional fraud intelligence risk signals for the most accurate results:

- User behavior: Identify potential fraudulent activity by detecting anomalies, such as window switching or unusual data entry speeds

- Device: Analyze fraud-associated characteristics like operating systems, hardware setups, and detecting jailbroken devices for enhanced security measures

- Network: Ensure legitimacy by cross-referencing IP addresses, geolocations, VPN usage, and network reputations

Identity & Document Verification

Confirm document authenticity

Identity & Document Verification

Onboard genuine users instantly.

Leverage our tranformational Al automation, passive liveness and our global document coverage to convert more users and mitigate fraud.

Database Verification

Grant access to verified users only

Database Verification

Deter fraud with a comprehensive check against government data sources, commercial registrars and third-party providers.

Know Your Customer (KYC)

Comply with global regulations

Know Your Customer (KYC)

Efficiently scale all KYC processes, from customer due diligence and data validation to risk assessment and record keeping, with Incode's Identity Ecosystem, featuring no-code workflow orchestration and biometric IDV.

Age Verification

Instantly Verify Customers' Age

Age Verification

Stay compliant and avoid up to 60% of user drop off

during sign-up

Anti-Money Laundering (AML)

Fight money laundering and

terrorist financing

Anti-Money Laundering (AML)

Screen and monitor customers against sanctions, watchlists and PEPs. Stop perpetrators and protect your

business.

Know Your Business (KYB)

Assess business risk

Know Your Customer (KYC)

Grow faster without increasing risk.

eKYB business verification is frictionless for customers and safe and compliant for your business.

Identity & Document Verification

Confirm document authenticity

Identity & Document Verification

Onboard genuine users instantly.

Leverage our tranformational Al automation, passive liveness and our global document coverage to convert more users and mitigate fraud.

Database Verification

Grant access to verified users only

Database Verification

Deter fraud with a comprehensive check against government data sources, commercial registrars and third-party providers.

Know Your Customer (KYC)

Comply with global regulations

Know Your Customer (KYC)

Efficiently scale all KYC processes, from customer due diligence and data validation to risk assessment and record keeping, with Incode's Identity Ecosystem, featuring no-code workflow orchestration and biometric IDV.

Age Verification

Instantly Verify Customers' Age

Age Verification

Stay compliant and avoid up to 60% of user drop off during sign-up

Anti-Money Laundering (AML)

Fight money laundering and

terrorist financing

Anti-Money Laundering (AML)

Screen and monitor customers against sanctions, watchlists and PEPs. Stop perpetrators and protect your

business.

Know Your Business (KYB)

Assess business risk

Know Your Customer (KYC)

Grow faster without increasing risk.

eKYB business verification is frictionless for customers and safe and compliant for your business.