Age verification

Age verification

Ensure Your Customers Meet Age Requirements

Faceplugin’s age verification solutions reliably and consistently confirm a customer’s age, ensuring compliance with legal requirements for age-restricted transactions.

How age verification works

Capture ID and biometrics

Capture ID and biometrics in real-time

Verify ID

Ensure valid Personally identifiable information (PII)

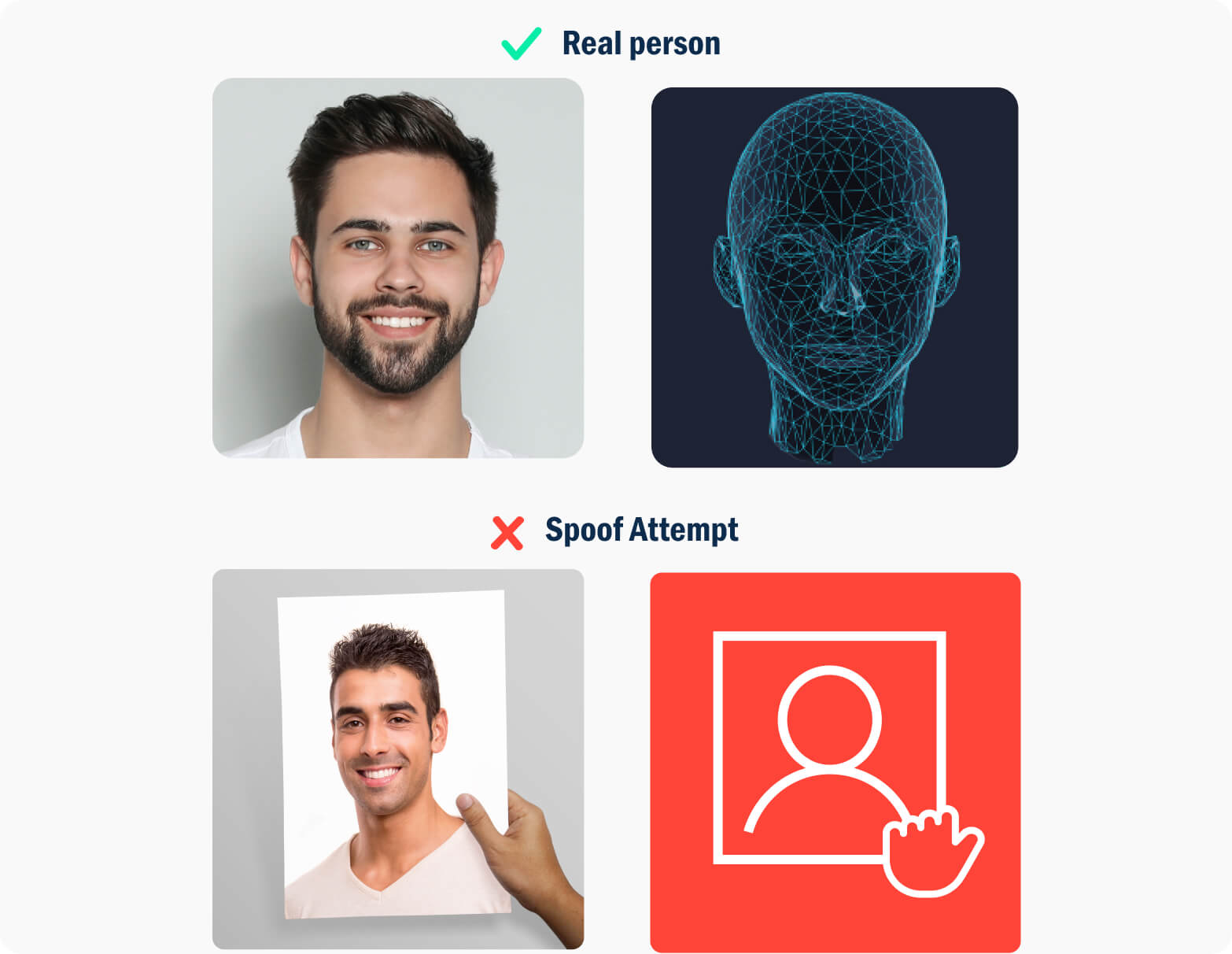

Liveness check

Complete Passive Face Liveness Detection to confirm person is physically present

Verify biometrics

Verify biometrics against captured ID

Check age

Instantly check if the person’s age is acceptable for accessing

offered goods and services.

Grant or deny access

Grant or deny access to the service

Identity & Document Verification

Confirm document authenticity

Identity & Document Verification

Onboard genuine users instantly.

Leverage our tranformational Al automation, passive liveness and our global document coverage to convert more users and mitigate fraud.

Database Verification

Grant access to verified users only

Database Verification

Deter fraud with a comprehensive check against government data sources, commercial registrars and third-party providers.

Know Your Customer (KYC)

Comply with global regulations

Know Your Customer (KYC)

Efficiently scale all KYC processes, from customer due diligence and data validation to risk assessment and record keeping, with Incode's Identity Ecosystem, featuring no-code workflow orchestration and biometric IDV.

Age Verification

Instantly Verify Customers' Age

Age Verification

Stay compliant and avoid up to 60% of user drop off

during sign-up

Anti-Money Laundering (AML)

Fight money laundering and

terrorist financing

Anti-Money Laundering (AML)

Screen and monitor customers against sanctions, watchlists and PEPs. Stop perpetrators and protect your

business.

Know Your Business (KYB)

Assess business risk

Know Your Customer (KYC)

Grow faster without increasing risk.

eKYB business verification is frictionless for customers and safe and compliant for your business.

Identity & Document Verification

Confirm document authenticity

Identity & Document Verification

Onboard genuine users instantly.

Leverage our tranformational Al automation, passive liveness and our global document coverage to convert more users and mitigate fraud.

Database Verification

Grant access to verified users only

Database Verification

Deter fraud with a comprehensive check against government data sources, commercial registrars and third-party providers.

Know Your Customer (KYC)

Comply with global regulations

Know Your Customer (KYC)

Efficiently scale all KYC processes, from customer due diligence and data validation to risk assessment and record keeping, with Incode's Identity Ecosystem, featuring no-code workflow orchestration and biometric IDV.

Age Verification

Instantly Verify Customers' Age

Age Verification

Stay compliant and avoid up to 60% of user drop off during sign-up

Anti-Money Laundering (AML)

Fight money laundering and

terrorist financing

Anti-Money Laundering (AML)

Screen and monitor customers against sanctions, watchlists and PEPs. Stop perpetrators and protect your

business.

Know Your Business (KYB)

Assess business risk

Know Your Customer (KYC)

Grow faster without increasing risk.

eKYB business verification is frictionless for customers and safe and compliant for your business.